Top 10 Beginner-Friendly Investing Apps

This analysis of the top 10 beginner-friendly investment apps should give a foundational understanding of what’s available and what to look for depending on your needs. Investment apps give users the convenience to trade in a wide range of investment products with their phones. Chock full of features, these apps include stock quotes, up-to-the-minute news, in-depth analysis, the latest research tools, personalized portfolio management, and the excitement of trading at their fingertips. Some apps offer automated investing services that use risk tolerance and financial goals to create customized portfolios. Robo-advisors take individual risk tolerance and financial goals and use them to generate customized investment advice. Trading apps provide industry news, insights, and analytics for informed investing, often with automated trading options. All-in-one apps combine trading, robo-advisory, banking, and lending services, making them a convenient and cost-effective choice for beginner investors.

With today’s security enhancements, investment apps are quickly becoming the most popular way for people to stay on top of their investments. Not only do they offer the convenience of investing on the go, but often there are additional features like discounted commissions or rewards programs for traders who use them regularly. Just as when managing a regular brokerage account, it’s crucial to consider the fees and security protocols of investing apps. Before investing or transferring money, users must carefully assess the company’s policies and the app’s features. Here we’ll explore the top ten investing apps for beginner investors, comparing fees, features, and benefits.

How to Pick an Investment App

When it comes to choosing an investment app, several key factors are important to consider. First, you should think about your purpose for the app: Do you need an app with educational content, or are you primarily looking to invest and trade? It’s also vital to compare the different types of fees each broker charges. High fees can cut in to your returns, so look for low-cost or commission-free trading. Finally, look at the different types of trading you plan to do. Not all brokers offer every option through their apps- for example, fractional shares are popular for their low entry costs, but they are not available on every app. Choosing an investment app requires careful research and consideration of these points to find the one best suited to your investment goals.

Acorns

Focusing on simplicity, Acorns is a unique and powerful way for new investors to build their portfolios without significant financial barriers. This app provides an easy way to begin investing by allowing users to round up the cost of their day-to-day purchases and invest the spare change into portfolios handpicked by Acorns’ experienced advisors. The app also allows users to purchase fractional shares, adding to its flexibility. Portfolio allocation is based on user age, experience, timeline, and goals to ensure the best returns. By cutting out account minimum balances, Acorns makes it simple for people who don’t consider themselves investors to have regular contributions toward their retirement goals. Acorns also prioritizes socially responsible investing (SRI) by choosing companies with strong Environmental Stewardship performance policies, aligning with ethical goals while ensuring profitability.

Ally Invest

Ally Invest is a platform specially designed for investors interested in stocks and bonds. This app allows you to have real-time access to trading anytime, anywhere, with no downloads required and no investment minimum. There are no fees on eligible stock and options trades, and they offer a range of investment products such as mutual funds, ETFs, and bonds.

The interface is very user-friendly and includes informative analytics so making decisions is easier than ever. The trading platform has data that can show live-streaming prices from all the major exchanges, allowing users the ability to track performance in different markets worldwide. These updates also come in handy when monitoring international investment opportunities or tracking recent movements in the market presented by easy-to-read graphs and charts all inside the app

Betterment

Betterment is an easy-to-use automated investment app that caters to users of all levels of sophistication. To make investing easier and more accessible, the app provides a broad range of services for everyone – from novice investors to professionals. It puts people in control of their financial journey by offering customizable portfolios based on their risk tolerance and goals, along with personalized advice that helps users stay informed and make better decisions. Betterment also has investing options for those looking for socially responsible ETFs or portfolios based on environmental concerns and social impacts.

Fidelity

Fidelity offers a comprehensive brokerage app with checking and savings accounts, credit cards, and investment accounts. They offer fractional shares, IRAs, bill paying, and more, making it possible for users to handle every aspect of their finances from the same source. Some key benefits are commission-free trades, no account minimums for brokerage accounts, and an expansive selection of mutual funds (over 10,000), ETFs (some with zero percent expense ratios), options, bonds, CDs, precious metals, and individual stocks. With competitive rates on banking items such as mortgages and auto loans plus helpful customer service available 24/7 for general inquiries, it’s easy to see why Fidelity has become so popular.

Invstr

Invstr is an excellent example of an investment app developed with beginners in mind. Inside the app, users can play a fantasy-style game featuring a virtual portfolio. Through game-play, the app offers users a chance to manage an imaginary portfolio without any financial risks and real money involved while simultaneously delivering educational content. Investing know-how learned within this environment can then be applied to real-world investing later on. The app also offers newsfeeds with updated stock analytics and information. This gives users all the tools they need to make educated decisions when investing in the US stocks, ETFs, and even fractional shares the app offers.

M1 Finance

M1 Finance has become one of the most popular investment apps due to its commission-free investing platform, fractional shares opportunities, and automatic deposits. It’s a great option for anyone looking to start up a long-term portfolio without having to pay fees or worry about allocating their funds correctly.

With the M1 Finance app, users can easily create a free, diversified investment portfolio of individual stocks and ETFs with just a few clicks. Automated deposits allow for budgeting convenience as well as balanced overall portfolios based on predetermined allocation preferences. For those serious about growing wealth over time while learning the basics of investing, M1 Finance is an excellent choice for beginners.

Robinhood

Robinhood is an investment platform that seeks to make stock trading accessible to everyone. Trading stocks on Robinhood is completely free and open to all with the use of fractional shares. There is also the option to invest in select cryptocurrencies. What sets it apart from traditional brokers is its no-fee policy, making it one of the most cost-effective investment apps on the market. The platform also offers a streamlined user experience with a modern design and intuitive interface. Limit orders and stop loss orders can be placed on stocks through Robinhood along with some basic research tools and advanced features useful for traders of all levels.

SoFi Invest offers numerous choices for investment in their app: automated investing, retirement accounts, crypto, and active investing. Commission-free trading and no account minimums make entry into the market easy for beginner investors. It also allows users to purchase fractional shares, meaning smaller amounts of money can still be used to invest in higher-priced stocks. Another feature of the SoFi Invest app is its IPO Investing option which allows users to take advantage of Initial Public Offerings (IPOs). With its numerous benefits and reasonable fees, SoFi Invest would be a beneficial choice for beginning traders who want reputable services with highly customizable options.

Stash

Stash is an excellent choice for those who want to learn the fundamentals of investing quickly, without getting overwhelmed by financial jargon. With a combination of insightful educational content and interactive games, Stash helps its users understand key concepts in investment strategy and diversification.

The app’s user-friendly interface allows users to customize their financial goals and actively track their progress. Stash also helps its users work with value-based investments while providing suggestions on portfolio building. With only a $5 minimum investment requirement, Stash is an exceptionally appealing platform for beginner investors looking for an accessible way to start investing in a wide range of investment products including stocks (including fractional shares), bonds, exchange-traded funds, mutual funds, or cryptocurrencies

TD Ameritrade

TD Ameritrade is a leading online broker offering individual stocks, ETFs, mutual funds, options, bonds, and futures. It has no minimum balance requirement, which makes it accessible to people of all backgrounds and investment levels. The well-designed app offers a comprehensive range of features and tools and its platform is designed to grow with you as you become a more advanced investor. It offers extended research capabilities, various trading platforms, educational content, and access to foreign markets all at your fingertips.

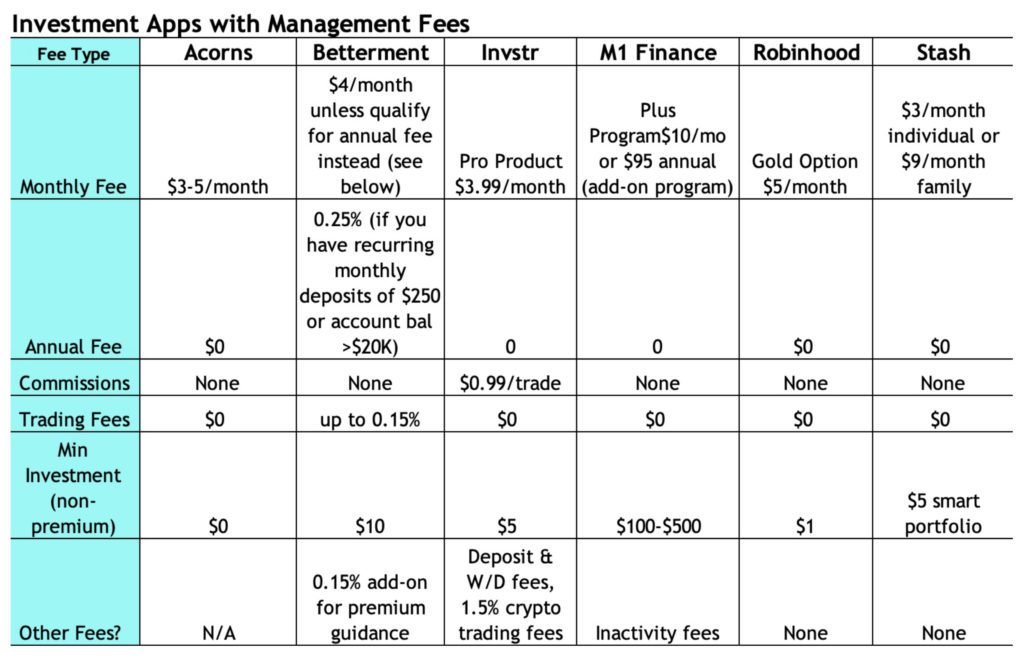

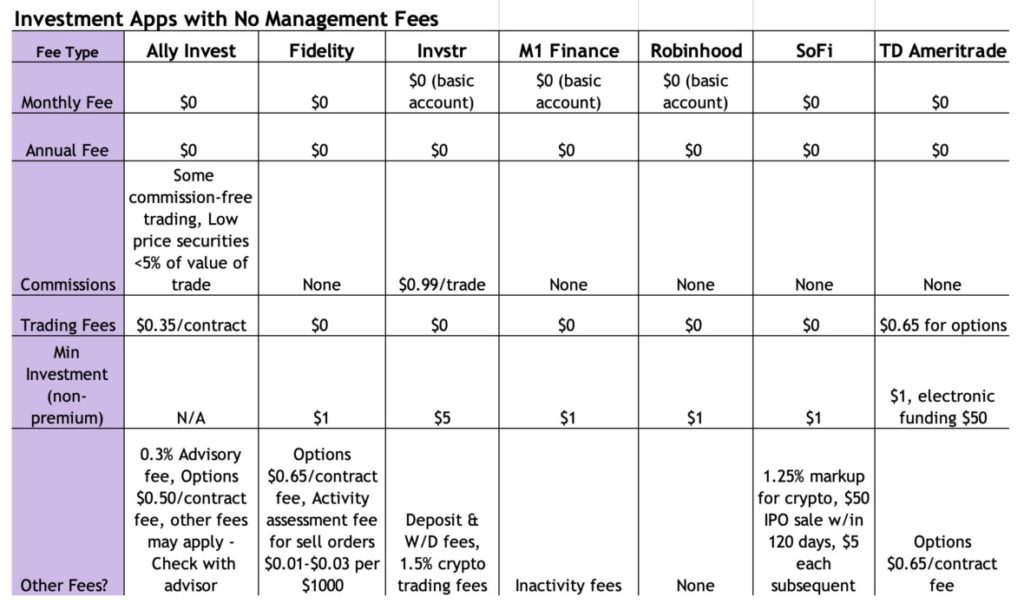

Investment Fee Comparisons

The fee comparisons below do not include Regulatory fees or fees for customer-requested services like paper copies of transactions, checkbook reorders, or other miscellaneous items that apply to all brokers. Be sure to check each company’s fee schedule for those prices.

Disclaimer: The Fees and commissions above are only for the standard, non-premium investment accounts (brokerage accounts). They do not include cryptocurrency trades or fees unless labeled as such. They were sourced from each company’s website in September 2023. The information is reproduced here as accurately as possible, though there may be errors or inconsistencies due to changes after the time of publication, or typographical errors. Please check with the company before signing any agreement and ensure you understand what you’re signing up for.

How Much To Invest, Which App to Choose, and When To Start

Deciding how much money to invest depends on many factors such as debts, disposable income, personal savings, and personal preference. It’s a good idea to diversify investments across high and low-risk investment products while keeping an eye on fees to help maximize your returns. There are investment apps for beginners that run the gamut from a focus on advice and educational materials to making sure you have access to all types of investments, to keeping things as simple as possible. Now that you’ve seen what the top ten apps for beginners can do, you can start the decision-making process and hit the ground running to reap financial benefits from day one. Here’s to your success!

READ NEXT: Personal Finance Book Reviews